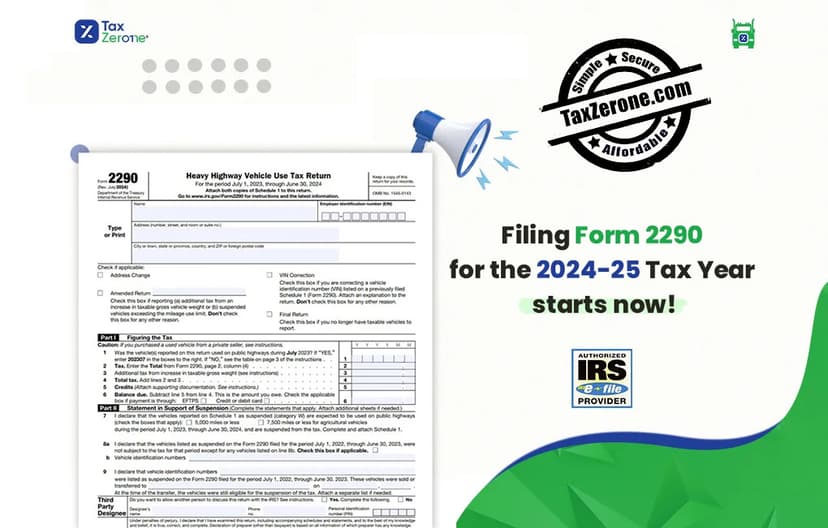

Missed the deadline? E-File Form 2290 now and get your stamped Schedule 1 to reduce IRS penalties.

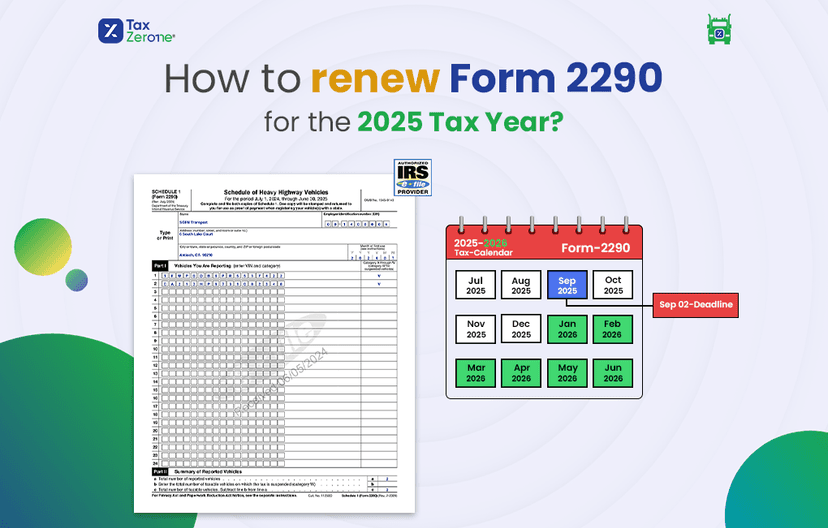

IRS Form 2290 E-filing for

Owner-Operators

- File Your Form 2290 Online in Just Minutes

- Get your stamped Schedule 1 instantly

- Correct VIN Errors for FREE

Starts at just $19.99 per return